Wowwo Q&A

This is a thread where you can ask your questions and write your Feedback about the Wowwo situation.

Dear Investors,

On December 17, 2021, we informed you that we made the decision to suspend loans originated by Wowwo from the Primary and Secondary Markets on Mintos until further notice.

The suspension is a cautionary measure to protect investor’s interests that is driven by macroeconomic changes which impact Turkish Lira exchange rate towards Euro. Given that Wowwo issues loans in Turkish Lira, but places them on Mintos in Euro, the company needs to pay the exchange rate difference from its own resources when forwarding borrower payments if Turkish Lira value drops.

As the Turkish Lira continued to depreciate rapidly, which could create a challenging environment for the company to meet its obligations towards investors on Mintos in a timely manner. We suspended Wowwo from the Primary and Secondary Markets.

Since then we shared also an update with you:

January 28, 2022

Dear Investors,

On Thursday, 27 January 2022, we had a meeting with Wowwo to further discuss possible solutions to the case of Wowwo's borrowers' repayments not being transferred to investors on Mintos. In the meantime, the funds due by Wowwo to Mintos and investors are moved to funds in recovery. The API communication system between Wowwo and Mintos was disconnected by the Turkish lending company due to currency risk that materialized for Wowwo as Lira continued to lose value against Euro.

In the most recent meeting, we exchanged information and proposals with the management of Wowwo, and we are planning to have a follow-up meeting next week when we will further discuss proposed options which will in the meantime be evaluated by both parties.

Mintos negotiations team is fully focused on coming to a resolution that will disrupt investors the least, as the case is currently classified “Stage 3”. You can find more about what this means in the article here:

https://www.mintos.com/blog/how-we-deal-with-loan-originator-issues-and-recovery-of-investor-funds/

As soon as we reach conclusions of value for investors and that can be publicly shared without disrupting our negotiation position, we won’t hesitate to update you immediately. In any case, we will share a more detailed follow-up after the upcoming meeting with Wowwo.

Please share your questions, thoughts and Feedback about Wowwo here.

-

Dear colleagues,

I wanted to share with you that I also invest in other p2p platform and they had loans in Ukraine and Russia. I received several communications from them. The lending companies affected are still paying the investors, using their cash reserves. Despite a war being fource majeure, the platform committed that their objective is that no investors will lose any money. The platform also will not collect any fees or payment for themselves on these loans, to contribute to the resolution. The communication is proactive, directly to the point and very fair. I am positively impressed.

And I cannot avoid to compare with Mintos approach on Wowwo case. The impression that I have is that the key point to Mintos is that they cannot lose their own money, and all the rest is secondary. I wanted to let you know that I made a complaint and received feedback from the Financial and Capital Market Commission of Latvia about Mintos´ handling of the Wowwo case. It is our right to contact the regulators: fktk@fktk.lv

0 -

Daniel Muniz Moreira could you share what these other platforms are?

0 -

One month ago I was pointing out that maybe a repayment straight away in TRY (as proposed by Wowwo) would not have been so bad and maybe Mintos should have asked investors before turning down the option. I was criticized for this. I guess now you see why I was saying this.

Also, by the way, Wowwo is up an running. You can just rent a car today with them: https://wowwo.com/ 1

1 -

@... @... seeing as these important questions have not yet been answered and my original post is already several pages back, here it is again:

-How did a LO that does not hedge its currency risk get allowed on Mintos? Mintos boasts doing its due diligence and having strict procedures before allowing LOs on its marketplace. So who was sleeping during this process?

-How did a LO that does not hedge its currency risk get awarded a risk score of 7?

-How did a LO that does not hedge its currency risk become part of Mintos conservative strategy?

All we get are empty promises from Mintos that they are negotiating and supposedly taking a strong stance, but Mintos is yet to acknowledge its serious negligence in this case which might very well cost Mintos' investors €20.000.000. As an investor I have watched this fiasco play out. Now there is a problem as well with Russian LOs being unable to pay even though several investors have said that these very same LOs are still paying on other platforms. None of this is doing my trust in Mintos any good. Without your investors' trust, you are nothing. What will Mintos do to regain investors' trust and make up for its negligence?

In addition: as David says, would it not make sense to let investors vote on how to proceed? It is after all our money and not Mintos's money that is at risk. All we hear is that Mintos is working on it but we don't hear the details of what factors Mintos is considering, which options it is exploring etc. We are not children. It is ultimately our money and we want Mintos to be more transparent about the different options to try and get our money back.

1 -

Gerardo Celso Guerreiro Mestre, TBD means “to be determined”. In other words, they have no idea.

0 -

Gerardo Celso Guerreiro Mestre Hi! TBD stands for to be discussed, as mentioned in the above comment. As soon as possible we will provide more information, thank you in advance for your patience and understanding!

0 -

Lucja (Mintos) would you also be able to answer my questions posted above? Investors' trust in Mintos is dwindling and so far, not enough is being done to restore it. Ignoring urgent questions in favour of answering a question that has already been answered is not helping.

2 -

3 months no progress, no legal action taken yet.

This is the 3rd time something like this happened since I joined Mintos in 2017. I assume that all money invested in Wowwo will be lost, which means in the last 3 months I lost more money on Mintos than I earned in 5 years.

On top of that it will probably take years until we maybe get back some of the money, and even longer until it is recognized as bad debt, just like with previous cases of LO defaulting / refusing to pay, so I'll have to wait until I can put my losses on my taxes and move on.

I always invested conservatively and only in the highest rated LOs. Buyback guarantees and LO ratings my ass, both don't mean anything.

Goodbye, I'll put my money elsewhere and I highly recommend others to do the same.

2 -

Lucija, Annija (Mintos), we all would be grateful if you could respond Petra Christina Zaagman's questions. We are not loosing money here, this is something out of our control, but our confidence on Mintos. We are requesting responses, specifically in a case where many of us invested "conservatively" in companies that are not actually what Mintos stated/disclosed from their scoring. I can accept loses and risks in my business, but I cannot accept being fooled or ignored. Please, communicate separately and privately to your investors in a clear manner (via email, for instance), with actions taken and to be taken in the next weeks. I am leaving this platform as I observe an extremely poor interest in preserving our confidence. As others have said, I am totally let down by Mintos due diligence process and internal procedures to score companies, this scoring is totally useless. Not factoring FX hedging into these scores may be a case of gross negligence and the poor information provided to your investors in this context may be understood as a willful intent for many of us to invest in these LO, would we invest here if all these risks had been disclosed? We took for granted many things here and we thought that Mintos was a well reputed company with experts behind, not only scripts and software developers.

3 -

I just spoke to a Mintos representative through the chat, and asked the exact same questions that I've asked on this forum twice (and other investors also urged Mintos to answer). The agent promised to forward my questions as well as my comments on Mintos losing our trust. I made it very clear that I expect a reply from Mintos on the investors forum today.

Other investors have already commented that they are leaving Mintos because of their manhandling of the Wowwo case and the complete lack of responsibility they take for their own shortcomings. I am still waiting for a reply to my questions, depending on which I too may leave.

1 -

In lengthy negotiations where Mintos has taken a strong position to reach an agreement that is satisfactory for Mintos investors, Wowwo management provided an unacceptable proposal that would give not more than a 25% recovery level over a 36 month long recovery period.

Besides finding the amount and the timeline unacceptable, there is also a lack of certainty that the company will follow the recovery plan even with the amount proposed, and a complete lack of valid arguments that would serve as a basis for the proposal, such as the cash flow forecast model.

https://www.mintos.com/en/funds-in-recovery-updates/

Answering investors' concerns related to hedging, we would like to highlight that it is included in the assessment of the Mintos Risk Score for the lending companies, but it's only one of many aspects we take into account.Since 2020 we became more insistent on the Lending Companies hedging their currency exposure. However, some currencies can't be effectively hedged, as there's virtually no derivatives (forwards, futures, options) market for it.

It should be also noted that FX risk is just another one among credit, macro, political, legal, and many other risks. If a particular kind of risk cannot be hedged, we mitigate it by requesting from the lending company more security in other areas, like having more stringent Equity/Assets covenants and so on.

Wowwo, with its shareholding companies, had the equity/asset balance that seemed more than sufficient to cover any potential future losses. As we underlined in answers before, the issue with Wowwo is the lending company's unwillingness to meet its duties, and this is why we're preparing for a new course of action in this case.

We will share all new details when we have new information.

1 -

@lucja

Are you serious ???

Yes FX is a risk but as I said thousand times we accept risk and wowwo also accept risk

But the situation is investor lost money but wowwo still running.

So how a LO can be healthy without paying.

If I loose the LO loose too.

Can you explain why there is asymetrie here?

0 -

Thank you Lucja (Mintos), this gives us as investors insight into how Wowwo ended up on Mintos, with a good risk score and as part of a conservative investment strategy. It also highlights the problem with Wowwo: they are able to pay, they simply choose not to.

For me, this shifts my concern. Knowing that Mintos did do its due diligence in ensuring that Wowwo was able to compensate for the FX risk, the problem now becomes what kind of precedent will be set. If Wowwo can simply walk away with €20.000.000 without any consequences, other loan originators may follow suit. As an investor I expect Mintos to set Wowwo an ultimatum. This situation is not only about recovering investors' money, but even more so about recovering investors' trust that Mintos is capable of taking a strong stance and not letting malicious LOs get away with an uncooperative attitude. Which in turn would hopefully prevent other LOs from trying to follow in Wowwo's footsteps.

I will continue to follow this case to see what happens.

2 -

Hello Lucja,

Thank you for your update.

We appreciate some regular updates on the situation on pre-determined dates.

When you communicate that there is will be an update on Fridays/every other Friday on status quo where you clearly address the issues, it is highly appreciated.

25 % recovery rate is not viable especially if the company can continue business as usual. I am a tax liable which means I am unable to deduct the losses from taxes if the company is not bankcrupt. Therefore, the recovery rate should be 100 % or bankcruptcy.

The situation looks like they want simply to get away from their liabilities. Mintos should take now strong approach to them, and be serious with law suit. And collect until fully recovered or bankcrupt. A failing LO is the risk we are taking here, not fraudulent actions.

1 -

And of course, in case of bankcruptcy, criminal investigations are necessary to ensure there is no fraud.

0 -

I agree with Jarmo. Updates on pre-determined dates, even if just to say that negotiations/actions are still ongoing, would be much appreciated. I also agree that it is all or nothing now. I am more than willing to accept losses or a partial recovery if a LO fails, but here the situation is different. Investors and also other LOs are watching. If it comes down to it (and of course I hope it doesn't!) I'd prefer to lose the money but send a strong message to other LOs that malpractice comes at the highest price.

1 -

No mercy! Go full force Liquidate this company. Such a business practice must not be crowned with success. We lose a maximum of 100% of our investment here, but other companies will not have the same idea. The time for talking is over now it is time to act.1 -

Dear Investors, please see the latest updates at the beginning of this Thread under "Official comment".

0 -

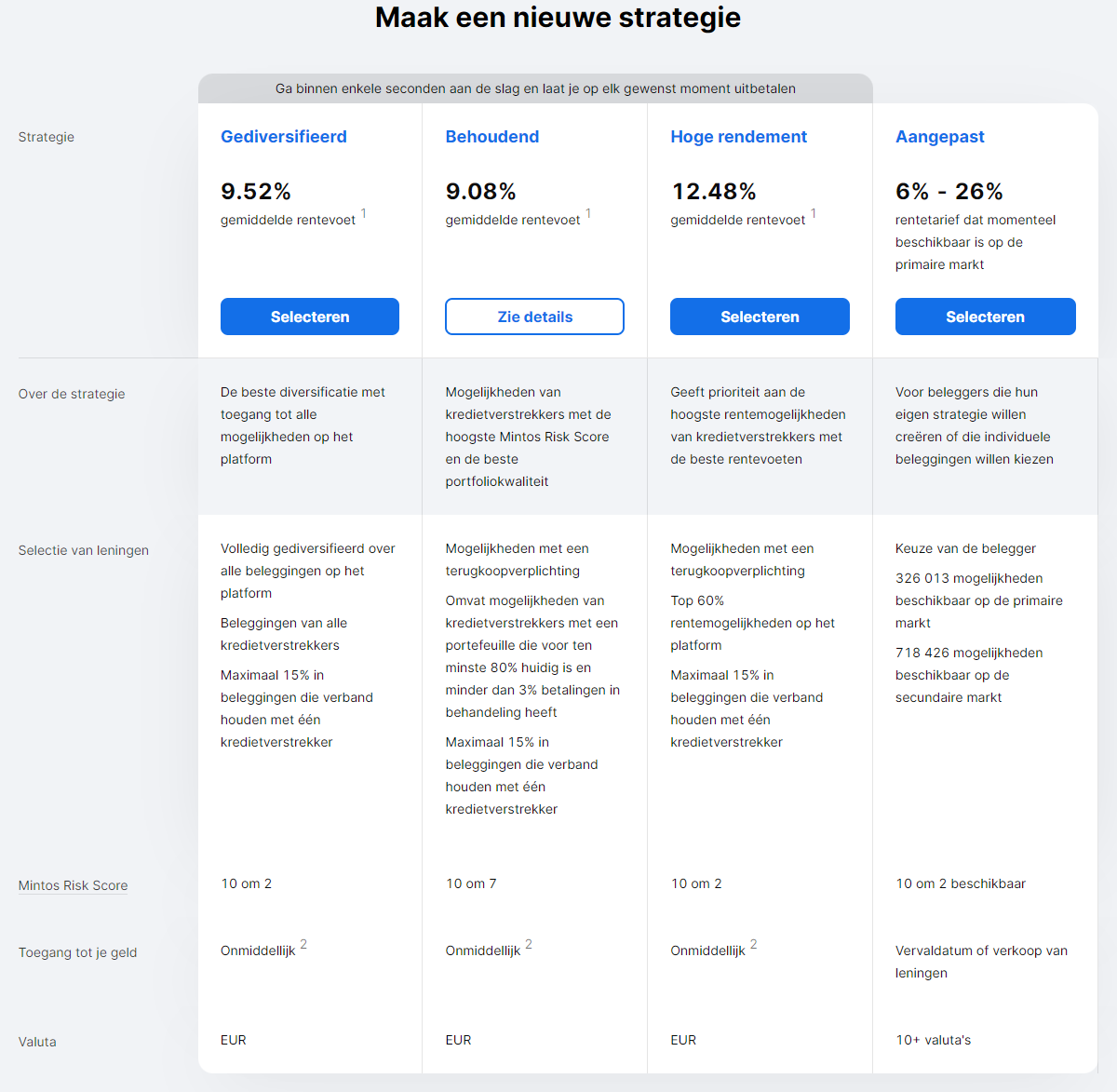

have you seen this campaign "Earn up to 5% cashback with Mogo Kenya loans" - this guys are advertising cash back on loans that are given in Euros but repaid in Kenya's currency - again, no information about the currency risk! I've starting to believe Mintos's is not willing to improve - there should be some kind of benefits flowing to Minto's we are not being informed! Is this a related party of Minto's

Annija how can this be possible? your governance is looking like a true mafia - you just try to cheat and trick everyone????

1 -

I'd like to know how long you will be "preparing for this new course of action"? Or are you waiting further? And in that case what exactly are you waiting for?

0 -

As stated by DANIEL MUNIZ MOREIRA, I've also filled a complaint to the Financial and Capital Market Commission of Latvia about Mintos´ handling of the Wowwo case. The communication from Mintos is unacceptable and lack of transparency is also unacceptable.

If Mintos doesn't take/proceed with legal action AND be transparent with their INVESTORS, the INVESTORS should file a complaint to Financial and Capital Market Commission of Latvia.

Please reach out to: fktk@fktk.lv

1 -

In case of non 100% recovery, one should also review to have legal action against Mintos. I am not sure but was as everyone completely in the dark that Wowwo was not hedging TRL and I thought to have EUR loans - it seems Mintos has not communicated this to investors. Reason: If being aware of this, I would have clearly focused on TRY/EUR conversion rate decline during Q3 and might have taken action to sell Wowwo loans on secondary market as risk occurred. As stated, I am not sure whether it was just my own mistake not to have analysed all Wowwo information properly, or there had really been a mistake from side of Mintos. But now let's cross our fingers first that Mintos is putting all efforts in getting the topic solved in a satisfying way.

1 -

Earn 10% cashback with Planet42 loans - business model similar do Wowwo, rent to own car subscriptions. Once more Minto's "forgets" to mention loans are given to a South African entity that will repay in Rands....being you're shareholder i'm very disappointed Mintos. I will propose a change in the ceo in the next meeting

0 -

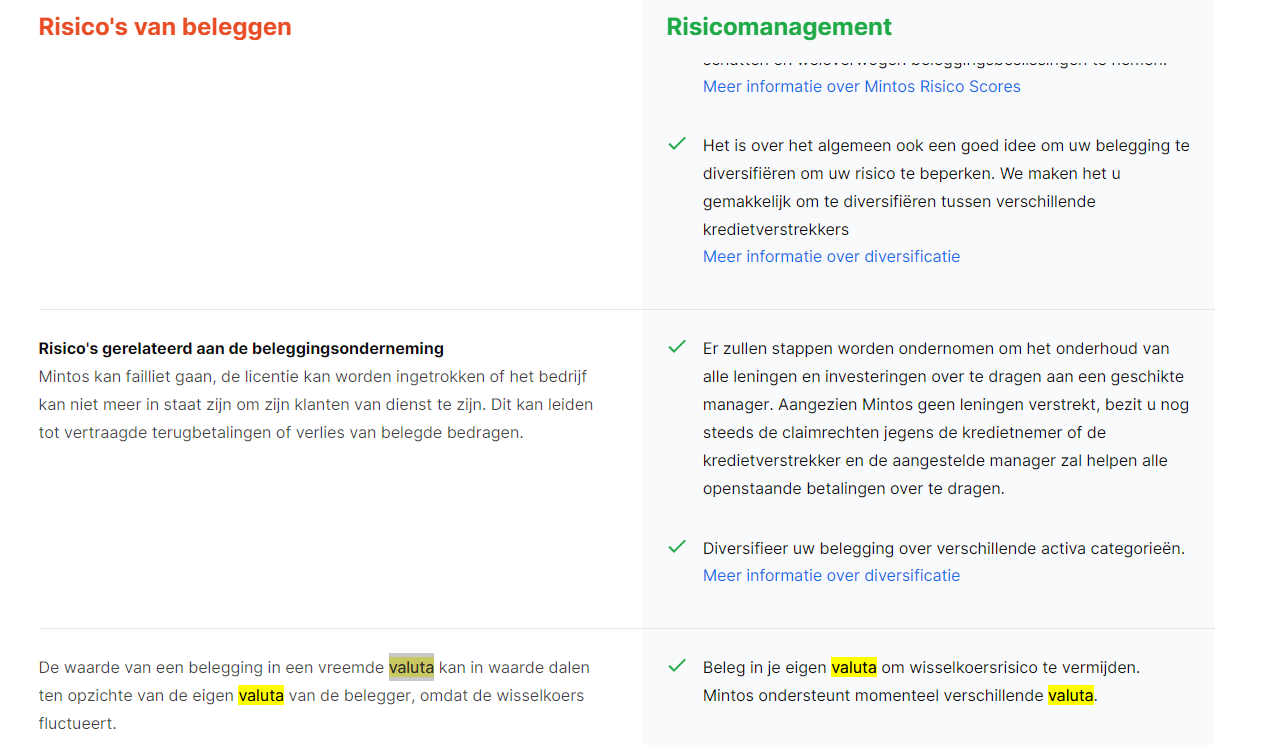

Mintos,

After more than 3 months of discussion about Fx-risks and informing (new) inverstors, your information on the platform is still inaccurate!

When reading the safety enclosure to learn about risks before of investing. You state that, by investing in your own currency is best to avoid currency risks (see all screenshot's below).

After reading this complete topic, and having more then 10% of my original investment in 'recovery', I learned the hard way that this information is not correct. Actualy I think the information is misleading!

1

1 -

Dear coinvestors,

I am receiving the same adverts from Mintos highlighting great returns from countries like South Africa. There is a big difference between negligence (not asking companies to hedge their loans), gross negligence (not reflecting sort of enforcement to pay back in cases like this, with sort of warranty to be triggered against the LO), and willful intent/tort/misleading adverts, there may be a clear intent from Mintos to be ambiguous for their investors to put the money in companies you would not go for if all risks were clearly disclosed to all of us in big capital letters. And this is against the law and EU directives, playing dirty and misleading messages have legal consequences, dear colleagues. To me, I am starting reckoning that Mintos is a bunch of under-35 geeks with great software developing skills, but zero knowledge on how financial markets and transactions work in real life. Amateurism in this sector has got a high cost, unfortunately we are paying all the bills. Honestly, I am not proud of myself, being here discussing with you all now, this means that I have failed in my own due diligence process, and I fully accept my own responsibility, but I will ensure that none of my colleagues and friends will invest and loose a penny on this platform. At the end of the day I work on the M&A business and Mintos is far, far away from the market's good practices and governance standards I took for granted initially. Totally disappointed.

0 -

i will stop my investing in mintos and try to get out all the money i can get asap. the situation with wowwo is ridiculous. i dont think we will get the money from wowwo back just because wowwo dont want to pay. if its that easy every company can do it.

0 -

Dennis

Thanks for sharing your feedback.

Investing in your own currency is the best way to avoid currency risk, meaning if you invest in the same currency as your local currency you are not directly exposed to currency fluctuation risks between your country currency and investment's currency, as your investments are received back in the same currency you invested in.

Also, minimizing risk does not mean excluding it completely. Information about the currency in which the loans are issued is available in each assignment agreement that comes with each investment and as well is included in the sample loans agreement available on Lending Company's page at Mintos. After receiving the investor's feedback we have also included this in each loan page, showing the currency in which the loan was issued.

0 -

@... @...

Please one more time.

I have said that a thousand times but non answer.

We accept risk and loss non problem it's part of the game.

But Why only investor take risk and not Wowwo ?

how can they Pursue their business without any problem?

If we loose THEY loose.

In this situation we loose but they win.

This is called ROBBERY.

So it's time to stop your generic answer and tell how ROBBERY is possible ??

0 -

@...:

This is not acceptable.

1. The currency risk was not disclosed before the situation happened. I don't care that now it's supposedly more transparent in which currency a loan invests in. It wasn't when you decided to block trading of Wowwos loans on your platform.

2. It's unacceptable that a loan originator can just refuse payment while they continue to operate. They stole millions from investors and it is your obligation as representatives of users on your platform to act in our interest and take legal steps immediately. Less than 100% recovery is only acceptable if a) Wowwo defaults on their obligations and b) Mintos incurs losses as well.

3. Your continued evasion of giving informative answers to legitimate questions of users and putting the blame on them for "not being aware of the risks" is insulting. You didn't properly disclose the risks and IT IS YOUR JOB to act in THE INTERESTS OF THE INVESTORS, which you refuse to do.

To everyone in the thread: any legal steps we can take against Mintos? I think I remember someone already posting they have filed a complaint.

2 -

@...

Why do you insist on calling this a currency risk, when it's a risk of the originator not abiding to their contract. And you gave this one one of the best risk scores that you have. I still hope that you will resolve this and regain the trust of the investors but for me in just testing the platform - it's a pity since it's really good but I have lost trust in the company (Mintos). And recently with all these high rates you look more like a ponzi scheme than a reputable marketplace.

0

Please sign in to leave a comment.

Comments

322 comments